As estate agents working in Coventry, we believe it's crucial to provide a comprehensive and realistic perspective on the local and national property markets. This approach aims to dispel the misconceptions often perpetuated by the media. Despite frequent reports predicting a housing market crash since September 2022, the actual data reveals that the British and Coventry property markets are holding steady.

National Homes for Sale

To understand the health of the property market, we should first examine the influx of new properties (listings) entering the market. In the second quarter of 2024 (April, May & June), 450,486 properties were listed for sale across the UK. This figure is higher compared to the 411,927 properties listed in Q2 2023 and the seven-year Q2 average (2017-2023) of 399,581 new properties.

The average price of a UK property coming onto the market in Q2 2024 was £454,223 compared to £438,551 in Q2 2023.

The number of new listings is a critical indicator of market health. During the 2008 financial crisis, the number of properties entering the market in Q1 doubled compared to the previous year of 2007, leading to an oversupply and subsequent price drops. Therefore, monitoring this metric helps gauge market stability.

A simple method to assess market trends involves using Zoopla or Rightmove. By tracking the number of properties for sale and those sold subject to contract (SSTC) weekly, you can calculate the ratio of sold to available properties. An increasing ratio indicates a strengthening market, while a declining ratio suggests a slowdown (although don’t forget there is a seasonal factor to this). For a more detailed analysis, you can break this data down by property type and price range.

National Sales and Price Bands

In Q2 2024, 308,969 properties were sold stc in the UK. This is much higher than the 269,989 properties sold STC in Q2 2023 and above the seven-year Q2 average of 299,324.

The average price of a UK property sold stc in Q2 2024 was £369,373 compared to £367,030 in Q2 2023.

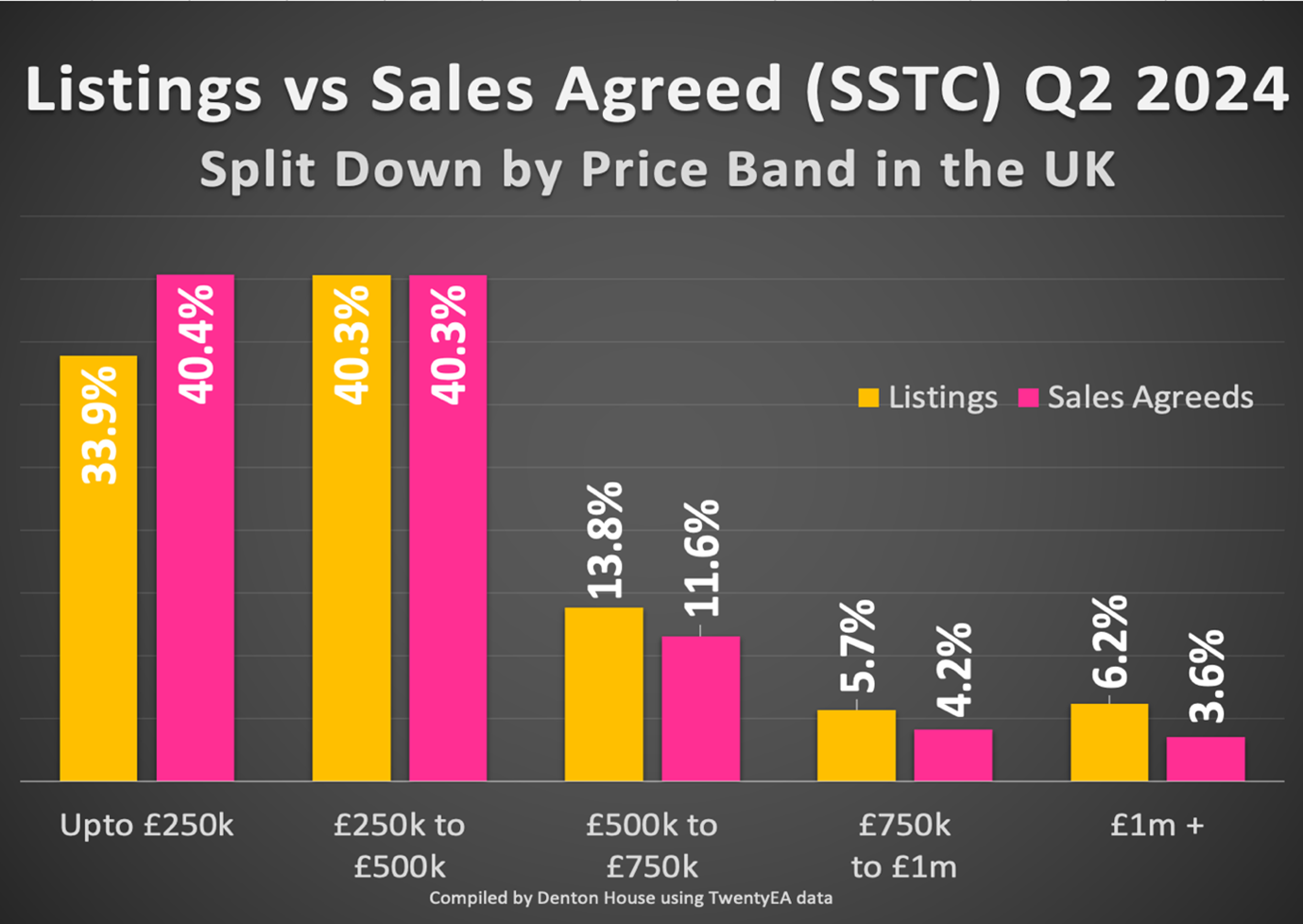

Examining listings and sales by price band provides further insights. In Q2 2024:

- 33.9% of new listings were priced up to £250,000, yet this segment accounted for 40.4% of sales.

- 40.3% of new listings were in the £250,000 to £500,000 range, and 40.3% of sales were also in this price range.

- 13.8% of listings were priced between £500,000 and £750,000, yet only 11.6% of sales occurred in this band.

- 5.7% of listings were priced between £750,000 and £1m, yet only 4.2% of sales occurred in this band.

- 6.2% of listings were priced £1m +, yet only 3.6% of home sales occurred in this band.

This data highlights a stronger performance in lower-priced properties, suggesting that affordability is driving the market.

Market Dynamics and Pricing Strategies

Pricing realistically from the outset is essential in the current market. In Q2 2024, there were 225,745 price reductions on the 673,973 properties on the market, indicating a need for initial realistic pricing to avoid subsequent price cuts, which can deter potential buyers. Also, it is interesting that the average number of properties for sale in Q2 in 2023 was only 605,667, a 11.3% growth in homes for sale.

Overall, despite the continued higher mortgage rates and economic uncertainties, the Coventry property market in terms of house sales has now surpassed the pre-pandemic activity levels, yet sellers should still aim to price their properties competitively to attract buyers where there are more homes for sale.

Coventry Property Market Specifics

Locally, in Coventry (covering CV1 to CV7 postcodes), 1,964 properties were listed in Q2 2024 with an average asking price of £295,118. The £200,000 to £250,000 price range saw the highest number of new listings, with 435 properties.

Sales in Coventry during the same period totalled 1,552 properties, with an average sale price of £260,206. The most active price range for sales was also the £200,000 to £250,000 bracket, with 394 home sales agreed.

First-time buyer properties are leading the recovery in Coventry, mirroring the national trend where lower-priced homes are more popular.

Conclusion

Ultimately, decisions about moving home should be based on personal circumstances rather than market conditions alone. If you are contemplating selling or buying in Coventry, we are available for a no-obligation chat to provide honest advice tailored to your situation.

Feel free to share your thoughts in the comments, and let's discuss how best to navigate the Coventry property market in 2024.

If you have any questions or need further insights, do not hesitate to reach out.